New for NovaPay Investors: Increased Bond Yields

15 October, 2024

NovaPay* has updated the interest rates on its corporate bonds. The rates depend on the bond purchase term, ranging from 1 to 12 months, and can reach up to 18% per annum.

“We have increased the rates for long-term agreements: by 0.5% for nine-month bonds and by 1.5% for one-year bonds. The new terms will especially appeal to clients who have already invested in this instrument and trust the company. They have already received their payments – on time, in full, to their NovaPay account”,– comments Ihor Prykhodko, CFO of NovaPay. “NovaPay securities offer a great opportunity for diversifying passive income sources, even with a minimum investment amount of 1,000 UAH”.

The current rates as of October 15, 2024 are:

- 1 month – 10%

- 2 months – 14%

- 3 months – 15.5%

- 6 months – 16.5%

- 9 months – 17%

- 12 months – 18%

During the sale period, NovaPay bonds have been purchased by over 2,600 Ukrainians for nearly 600 million UAH.

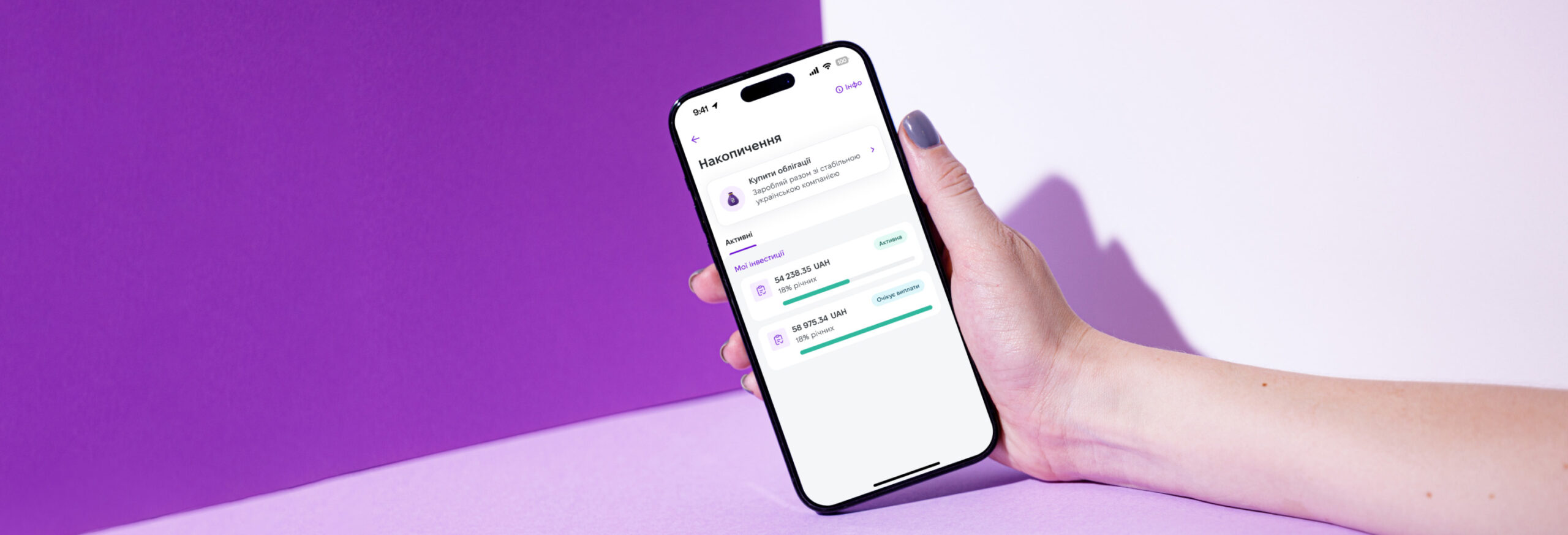

The securities can be purchased in the NovaPay mobile app in just a few minutes. To do this, you need to:

- on the main screen, select the “Savings” section and click “Buy Bonds”;

- choose the terms: the duration and the investment amount;

- сonfirm the application, sign the documents via Diia.Sign and make the payment for the bonds. Once the purchase process is complete, the client will receive a push notification.

The app automatically displays the expected payout amount. After the bond agreement term ends, the income will be credited to the client’s NovaPay account.

As a reminder, last year, NovaPay registered three public issues of interest-bearing bonds of series A, B, and C, each worth 100 million UAH. In 2024, the company issued three more such securities – series D, E, and F. The rating agency “Standard-Rating” confirmed NovaPay’s corporate bonds with a credit rating of uaAA, which is the highest among Ukrainian financial institutions.

* The issuer of the bonds is NovaPay Credit LLC.

Back to news

Back to news