For big and small purchases 💸

Enjoy up to 62 days of grace period and convenient management in the app – buy now, pay later without overpaying.

Pay for cash-on-delivery parcels with your credit card and avoid paying fees for using credit funds 👍

Use a virtual card or get a stylish plastic credit card.

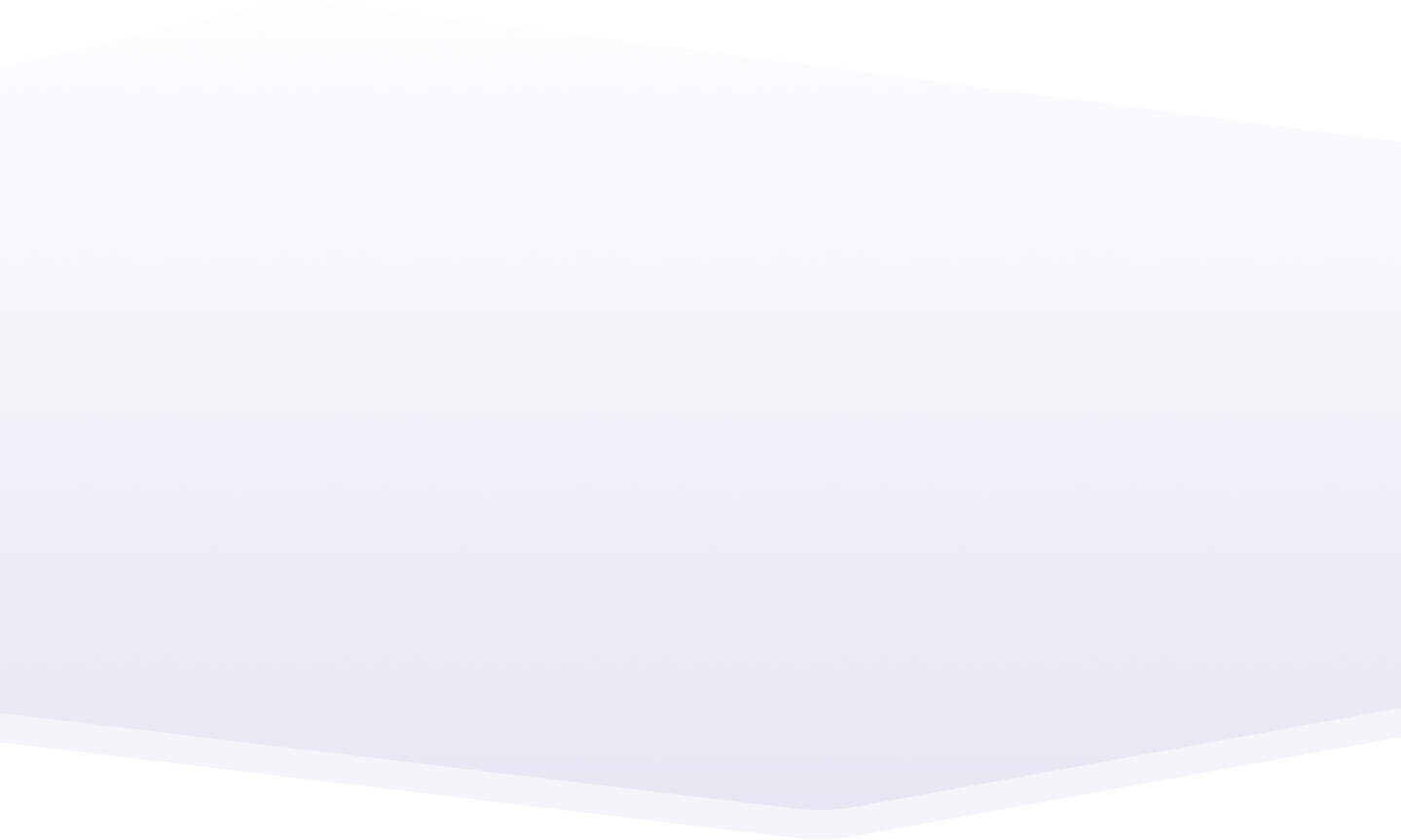

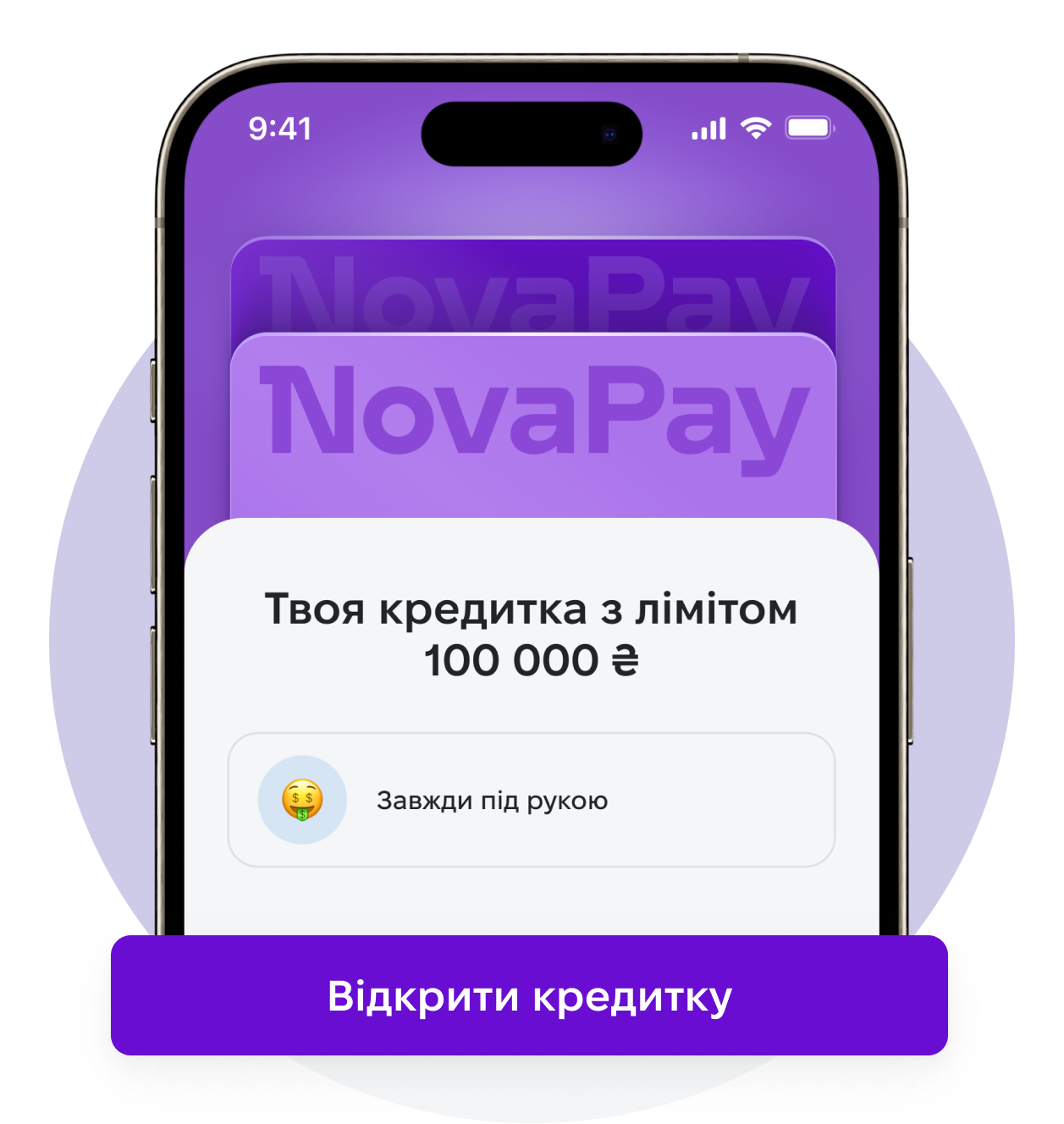

📲 Open your Visa credit card directly in the NovaPay app Find out your credit limit and take money when you need it 💰

NovaPay credit card is

👌 up to 62 days without overpayments

take it now, pay later💰 credit limit up to UAH 200,000

with a reserve for all plans💸 for any payments

shops, cash-on-delivery at Nova poshta, utility bills, transfers by IBAN and to a card📱 full control in the application

conveniently apply, repay, and control the limitHow to open a NovaPay credit card

OR

02

03

How much does it cost

01

03

TERMS and CONDITIONS

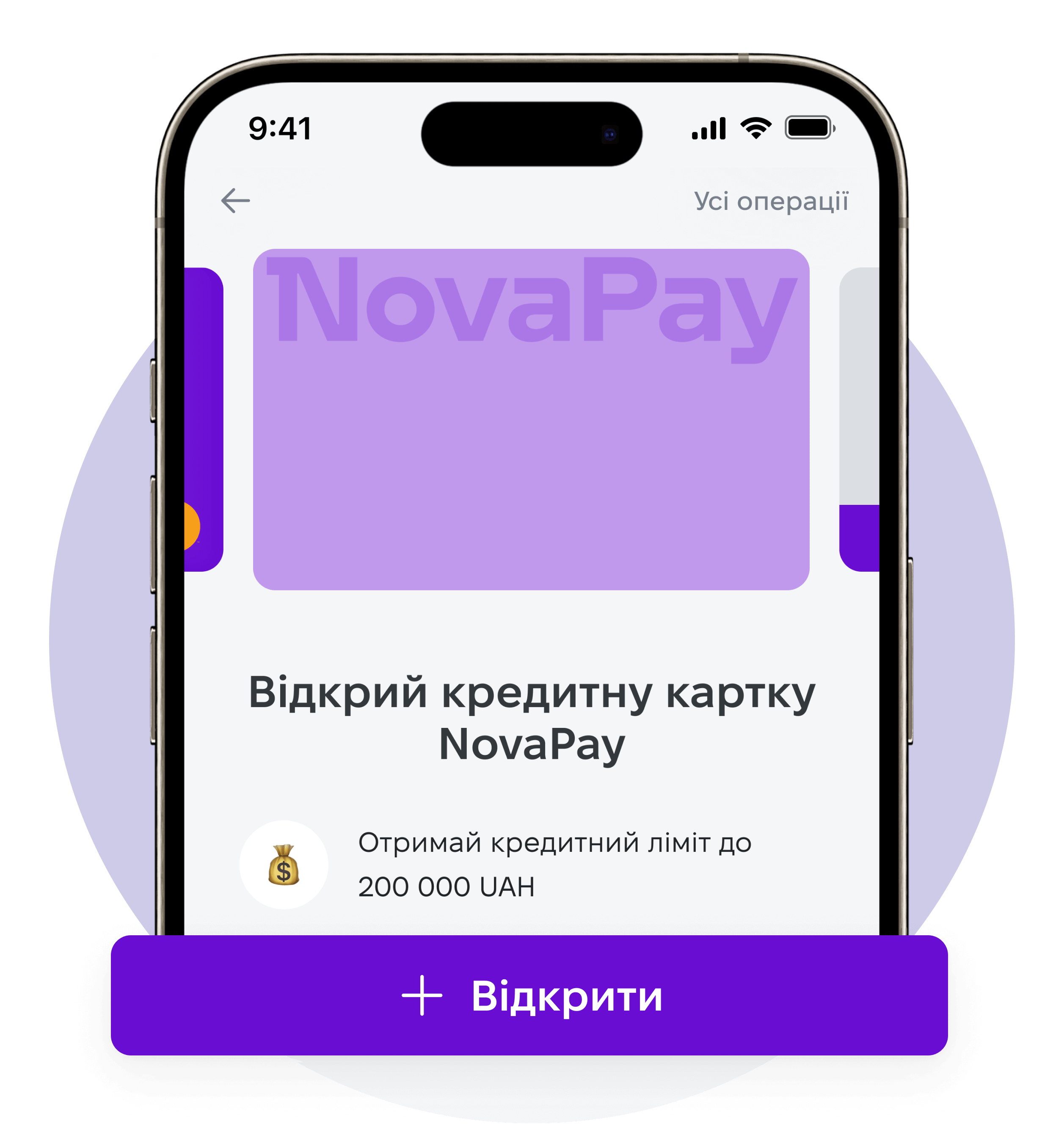

💳 Limit: from UAH 0 to UAH 200,000

📆 Term: 12 months

💰 Rate:

– concessional – 0,00001% per annum

– base – 5% per month (60% per annum)

📅 Minimum monthly payment

The real annual interest rate is 79.59%

Warning

Warning of possible consequences in case of using the service or failure to fulfill obligations under the agreement:

- for non-payment or late payment of the mandatory minimum payment, the consumer must pay a fine of UAH 150 and 60% annual interest on the overdue amount;

- breach of obligations under the agreement may negatively affect the credit history and make it difficult to obtain a loan in the future;

- NovaPay does not have the right to require the consumer to purchase goods or services from its own or related parties;

- the consumer has the right to get acquainted with alternative credit options and financial institutions before deciding on a loan;

- NovaPay has the right to change the terms of the agreement with the consent of both parties;

- the consumer may refuse to receive advertising materials by calling 0 800 30 79 79;

- loan costs depend on the payment method chosen by the consumer;

- the consumer cannot extend the loan or credit repayment period;

- the term of the agreement and the limit are automatically extended for the same period unless either party (the consumer or NovaPay) notifies of the intention to terminate them.

FAQ

What is a NovaPay credit card?

Our credit card was created from the credit products of two companies operating under the NovaPay brand: a card from NovaPay and a revolving credit line from NovaPay Credit. 💳 A credit card from NovaPay is used for purchases and payments within the established credit limit. 💵 And the revolving credit line from NovaPay Credit automatically covers your debt to NovaPay, providing you with continuous access to money.

How to open a NovaPay credit card?

✅ Install the NovaPay app. Open a credit card 💳 immediately during registration in the app. ✅ Or open it whenever it's convenient in the ‘Wallet’ or ‘Loans’ sections 👉 Tap ‘Open’ and review the terms of use 📄 👉 Sign the agreement with the code from the SMS and create a PIN code for the card 🔐 Want a plastic card? Order delivery to a Nova poshta branch or parcel locker.

Who can apply for a card?

Citizens of Ukraine aged 18 to 69 with the NovaPay mobile application

What transactions are covered by the grace period?

The grace period of up to 62 days applies to: ✅ payment for goods and services at retail outlets and on the Internet; ✅ payment for cash-on-delivery parcels in the NovaPay app; ✅ mobile top-up, utilities, charity, fines, and fees/taxes, Internet and TV payments, educational and insurance services, etc. in the NovaPay mobile application; ✅ mobile top-up at Nova poshta branches; ✅ payment of bills under the contract at Nova poshta branches

How can I stay in the grace period?

Pay off the entire debt by the end of the following month

What is the minimum payment?

0.01% of the debt amount at the end of the current month + accrued interest, but not less than UAH 100

By what date is the mandatory minimum payment due?

The mandatory minimum payment must be made by the end of the following month. If this is not done on time, the debt will become overdue

Can I repay my loan debt early?

Yes, of course. You can repay the loan in full early without additional fees and interest, paying only the interest for the actual term

Why do I not have a credit limit?

The credit limit is calculated automatically and depends on your financial activity, credit history, and other financial factors

Why can't I apply for a credit card?

Card issuance and the credit limit are determined individually for each client. Check your personalized terms in the app next month 😉

Is using the “Benefit” service with a credit card possible?

Yes! The benefit will be instantly credited to your purple card

What is the real annual interest rate on a credit card?

Up to 79.59% per annum. The exact calculation depends on the terms of repayment

What happens if I pay more than my credit limit?

This overpayment will remain on the card and you can use it as your money

How can I fully close my credit limit and how much does it cost?

Just top up your card in the NovaPay app, using your IBAN details, or at a Nova poshta branch. After that, interest is no longer charged 👌

Where can I find out about debts and payments?

In the NovaPay application, go to the “Loans” menu or call 0 800 30 79 79. You can also visit a Nova poshta branch with your passport

What type of card does the NovaPay Credit Card offer?

You will receive a Visa Debit Classic card. It allows you to pay for purchases online and offline. You can use a virtual card only, or order a plastic credit card in the NovaPay app

What’s the difference between Mastercard World Debit and Visa Debit Classic?

There is almost no difference in usage. Both Mastercard and Visa allow you to pay for purchases online and offline. The only difference is in the payment system that processes transactions – Visa or Mastercard.

Will the Credit Card rates change after switching to Visa?

No, the rates remain the same. No hidden changes – everything’s just as transparent as before 💳✨

Does Visa have any loyalty programmes?

Yes, of course! Visa offers nice bonuses, discounts, and promotions 🎁 Check out the latest offers 👉 here

Place for

Place for