Fake chats have no chances: NovaPay launches its own secure live chat

24 November, 2025

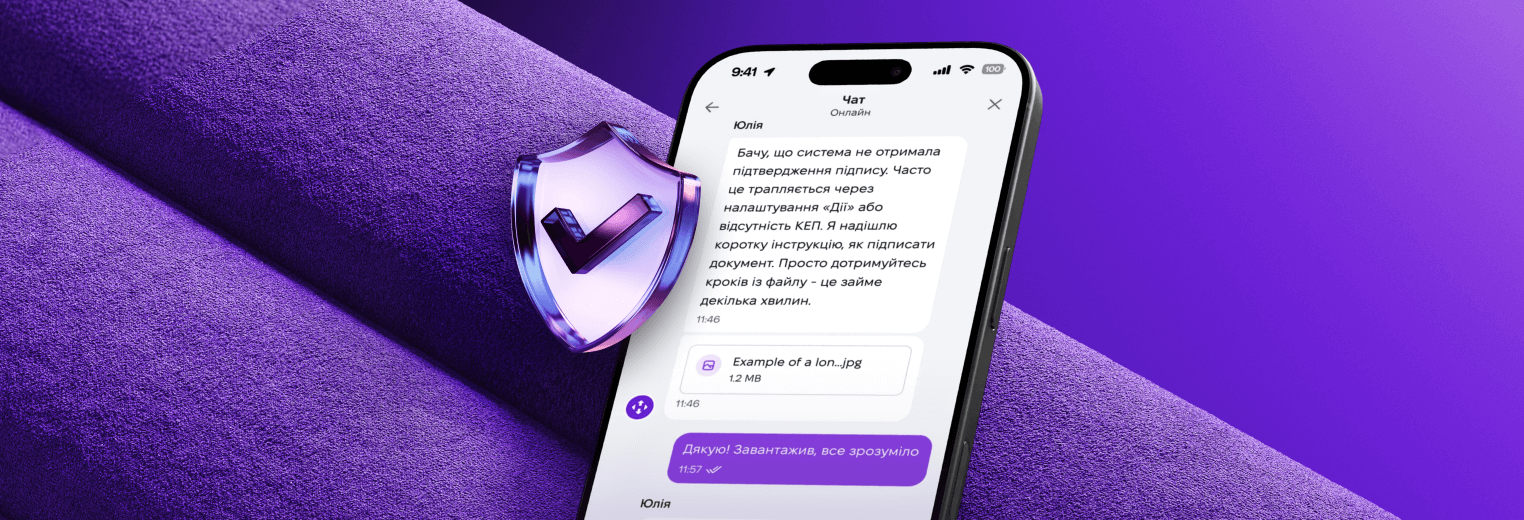

The NovaPay app now features a new way to communicate with customer support – a live chat that is available directly in the app, in the Support Centre.

The main advantage of the new live chat is user security. Communication takes place exclusively within the NovaPay app, so you don’t risk encountering fake accounts or fraudulent chats in messengers. All messages within the chat are protected, so your data remains completely confidential.

‘The number of phishing attacks via fake support chats is growing every year. Fraudsters create accounts that appear official and lure people into sharing their card details, passwords, and SMS codes. The live chat in the NovaPay app eliminates this risk: you always communicate with real support, and all data remains confidential and secure,’ comments Yana Levada, Director of Business Development at NovaPay.

The new chat is not just about text messages. Users can:

- communicate with customer support in real time;

- send files (screenshots, documents) for faster issue resolution;

- receive files from customer support (instructions, references);

- rate the conversation after the chat is over to help improve the service.

The new chat makes assistance not only prompt, but also secure — exactly as it should be in a modern financial service.

‘In the near future, we plan to completely abandon customer communication via messengers and switch our support to live chat. During the first week after launch, about 20% of users chose to communicate through our chat, which confirms that we are moving in the right direction,’ comments Oleksandr Hrachov, Director of Customer Experience at NovaPay.

NovaPay is an international financial services company under the NOVA Group (Nova poshta). It has been providing online and offline payment solutions in over 3,600 branches for 13 years. NovaPay was the first non-banking institution in Ukraine to receive an extended licence from the NBU to open accounts and issue cards.

Back to news

Back to news