You have an order. How about a credit for the parcel?

It’s easy to apply in our NovaPay app:

👉 find out your total limit;

👉 order product with delivery to Nova poshta;

💵 the cost of the parcel (cash-on-delivery) and Nova poshta services must be at least 500 UAH and within your credit limit;

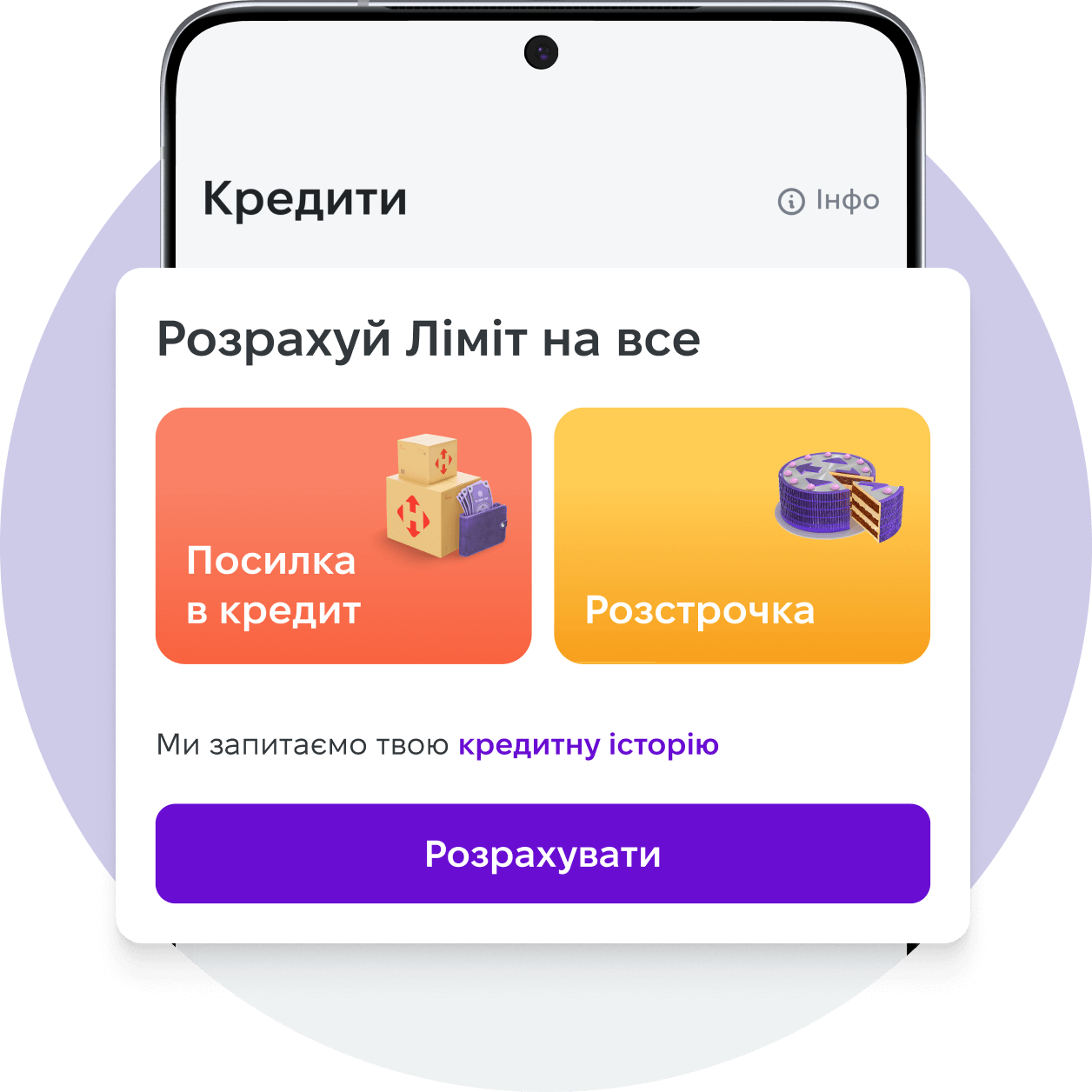

👉 select one or more parcels in the app and tap ‘Pay on credit’.

That’s all; pick up your order immediately and pay for the credit in the NovaPay app.

The loan is provided by NovaPay Credit, which is part of the NovaPay financial group and part of the large NOVA family.

Find out your credit limit in the NovaPay app and pick up your parcels on credit at a Nova poshta branch

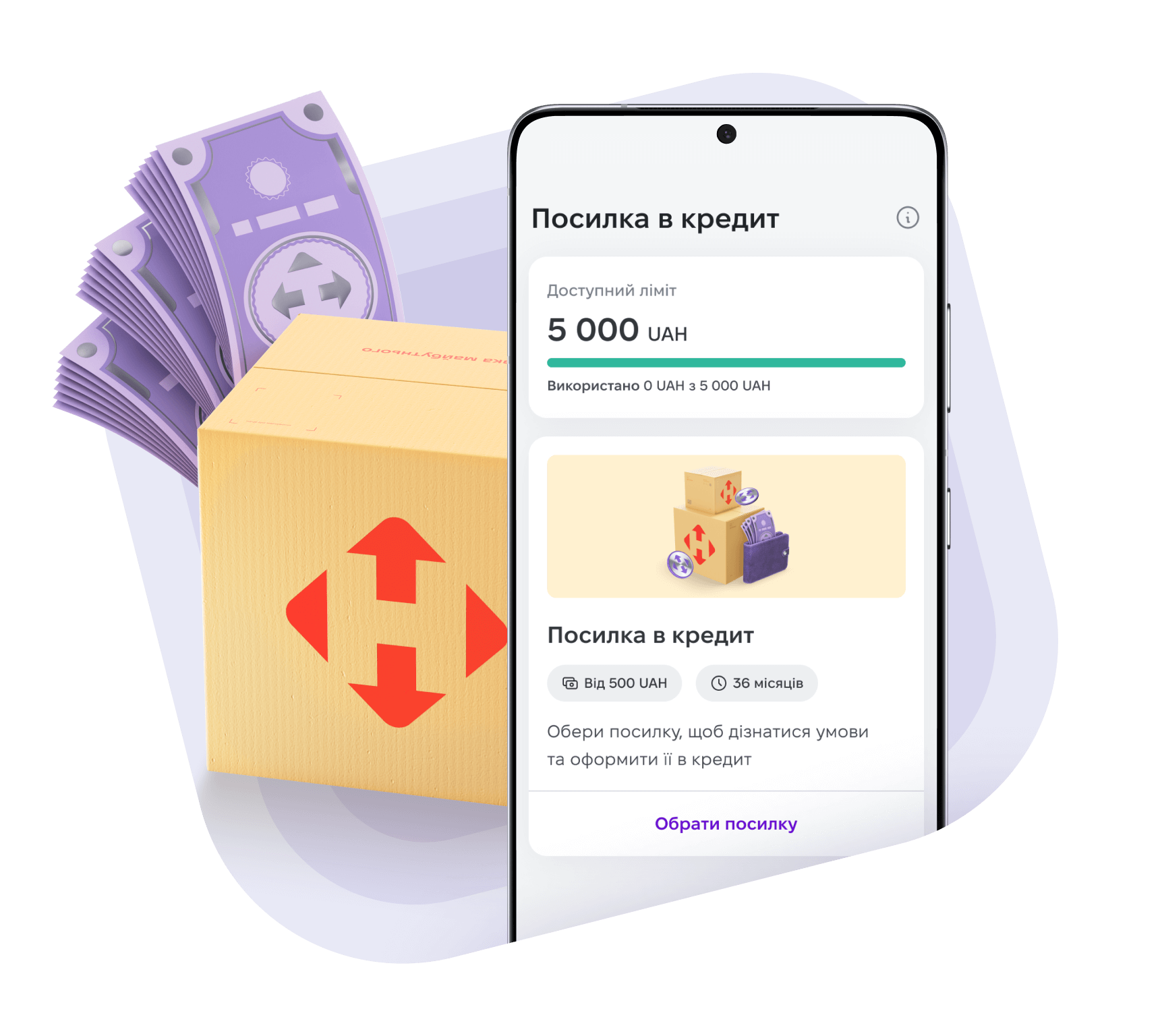

Find out the available amount for the parcel on credit

in the NovaPay app

download from the App Store or Google Playin a branch

with a passport and TIN codeHow to order a parcel on credit

in the NovaPay app

01

02

03

04

How much does a parcel on credit cost

Want to buy a tablet for UAH 10,000 on credit...

01

02

03

04

The payment schedule will indicate the exact amount of the monthly payment

The payment schedule will indicate the exact amount of the monthly payment

Terms and conditions

- Amount – from UAH 500 to 200,000

- Term – 1-36 months

- Without a down payment

- Rate – 0.00001% per annum

- Real annual interest rate – from 38% to 206%

- Fee – from 2.5% to 6.0% per month and is determined individually

Essential characteristics of the service and Warnings about the consequences

FAQ

Who can receive an order at Nova poshta on credit?

Citizens of Ukraine aged 18 to 69 years who send or receive orders at least once every six months can use the NovaPay Credit

What can I buy on credit via Nova poshta and for what amount?

You can take out a loan for any goods delivered via Nova poshta or delivery services, provided their cost is at least UAH 500. The transfer fee is also included in the loan amount. The maximum amount depends on your credit limit

Is it possible to get a loan after inspecting the goods?

Yes, of course. First, check your order and, if you are satisfied, apply for a loan in the NovaPay app. Only when you apply for a loan does NovaPay Credit pay for the shipment, and you repay us within the period you chose when applying.

Can I purchase several orders on credit at once?

Yes, you can purchase several parcels on credit at once if their total cost does not exceed your total limit.

What do I need to purchase a parcel on credit?

You can order a parcel on credit in the NovaPay app 👉You need a shipment that costs between 500 UAH and the amount specified in your total limit. It can be one parcel or several. What is really important is that their total cost does not exceed your limit. Delivery costs and transfer fees are also included in the loan amount. 👉Install the NovaPay mobile application, complete the onboarding procedure, and open an account with NovaPay LLC. 👉Go to the ‘Loans’ menu at the bottom of the screen and tap ‘Select parcel’. Or, in the parcel menu (e-waybills), select one or more parcels worth 500 UAH or more to apply for credit. 👉Read the loan terms and click on «Apply for a loan». Read the loan documents and click on «Sign». 👉You will receive a message on your phone with a password to sign the documents in electronic format. Enter the received password in the app and wait until we open the loan and pay for your parcel. After you see the message on the screen about the successful loan, you can pick up the parcel at the branch or the parcel locker.

Who provides the loan to receive a parcel at Nova poshta?

The loan is provided by NovaPay Credit LLC, a part of the NovaPay financial group and a part of the large NOVA family. The company has all the necessary licenses and permits from the NBU. More information about NovaPay Credit LLC

Will you check my credit history?

Yes, when applying for a credit plan at the Nova poshta branch

What are the terms and conditions of the parcel on credit?

The loan is provided for 36 months. The annual interest rate for using the loan is 0.00001%. Loan servicing fee ranges from 2.5% to 6.0% per month and is determined individually. Real annual interest rate – from 38% to 206%, the rate depends on the amount, term, date of loan issuance, and creditworthiness assessment results. Any shipment worth from UAH 500 to the amount specified in your personal credit limit can be issued on credit. You need to pay the loan in equal installments every month.

Can I order a new parcel on credit if the previous one still needs to be paid in full?

Yes. You can place a new order on credit within your total limit.

How long does it take to process the order?

Usually, it takes about 5 minutes to issue a parcel on credit in the NovaPay app or at the Nova poshta branch.

How do I pay on credit?

Pay for the parcel on credit with equal monthly installments. The payment schedule is described in the loan passport. You can pay in the following ways:

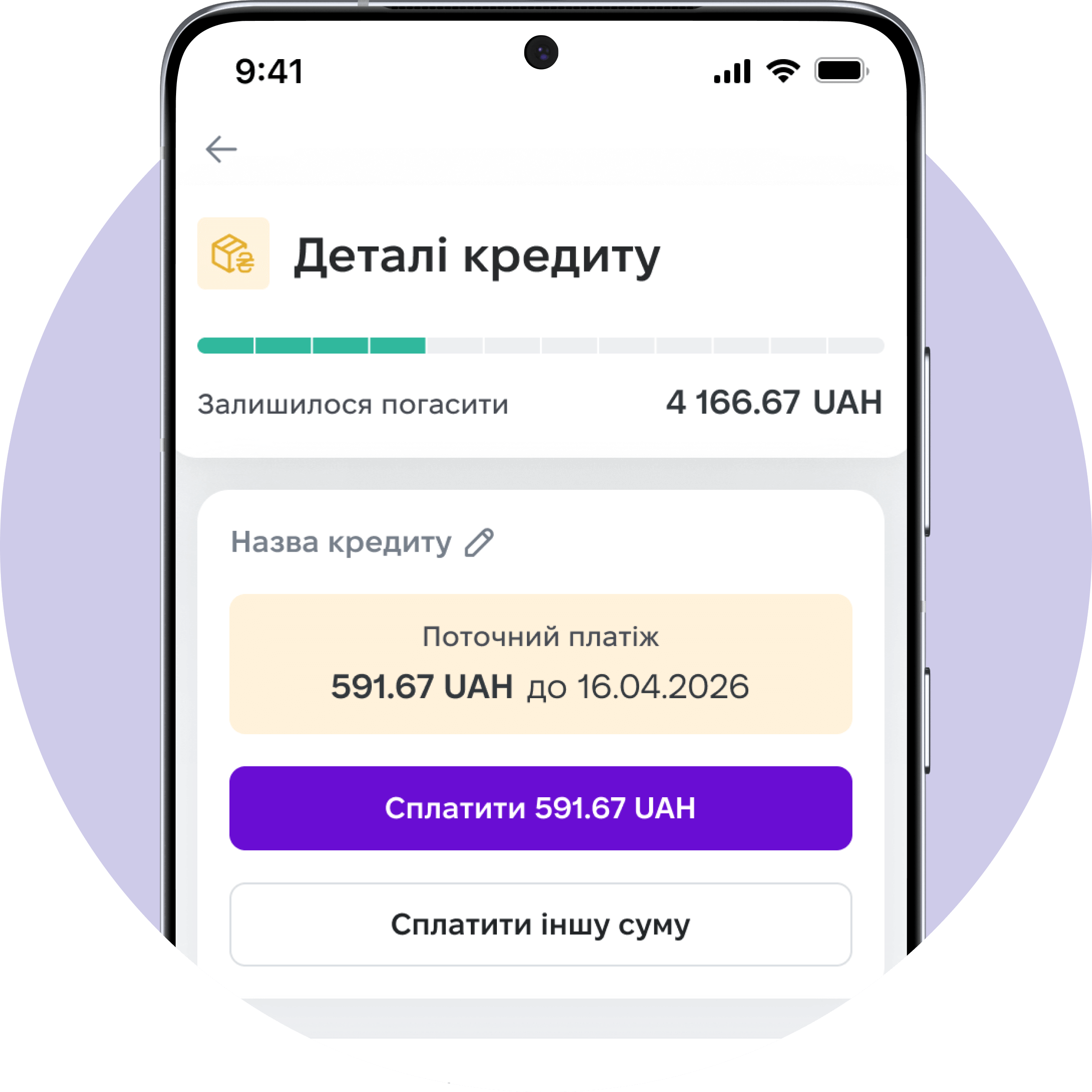

- In the NovaPay mobile application. To do this, go to the «Loans» menu at the bottom of the screen and select the desired loan. On the loan you want to repay, click on «Repay». Select the required amount and pay with your bank card.

- In the Nova poshta mobile application in the «Personal Account». To do this, click on the person icon at the top of the screen. Then select «Parcel on credit» and go to the «Open loans» section. On the loan you want to repay, click on «Repay». Select the required amount and pay with your bank card.

- You can do it at the Nova poshta branch

The services are provided at NovaPay points located in Nova poshta branches. by card or in cash. You must provide your surname, name, patronymic, and phone number to pay. If you have several loans with NovaPay Credit, you will also need the contract number indicated in the application for a tranche.

- Independently using NovaPay Credit details at any bank or online service.

Payment details: Payee: NovaPay Credit LLC EDRPOU: 40055034 Recipient's account: NO. UA509358710000067315000000161 Recipient's payment institution: NovaPay LLC Purpose of payment: Repayment of the loan under Application No. XXX for accession to the agreement. Borrower's full name. Borrower's tax identification number.

How much will I overpay for the goods for the entire period of using the loan?

You can see the details of all the terms and conditions and payments in the documents that will be generated during the registration process.

When do I need to pay the loan?

Pay for the parcel on credit with equal monthly installments. The payment schedule is described in the loan passport. You will receive a link to it in a message when you apply for a loan. You can pay the monthly installment a few days before the scheduled date. It is useful to do this if the payment is made using the NovaPay Credit details at the bank or through online services.

Can I pay the loan for another person?

Yes, any person can make a scheduled payment and repay a debt or a loan in full. To do this, when paying at the Nova poshta branch

How does the seller receive funds for the parcel on credit, and who will be indicated as the payer in the documents?

The funds are transferred to the seller's details when a credit is granted. Such a payment is similar to a regular cash on delivery. The recipient of the goods (the person in whose name the parcel is issued on credit) will be indicated as the payer for the EW.

How is the credit limit calculated?

Your total limit is calculated automatically based on your credit history, monthly income, and other factors that affect your solvency.

Why don't I have a credit limit?

Most likely, we do not have enough information about you to calculate your credit limit. The credit limit is calculated automatically based on your credit history, monthly income, and other factors that affect your solvency.

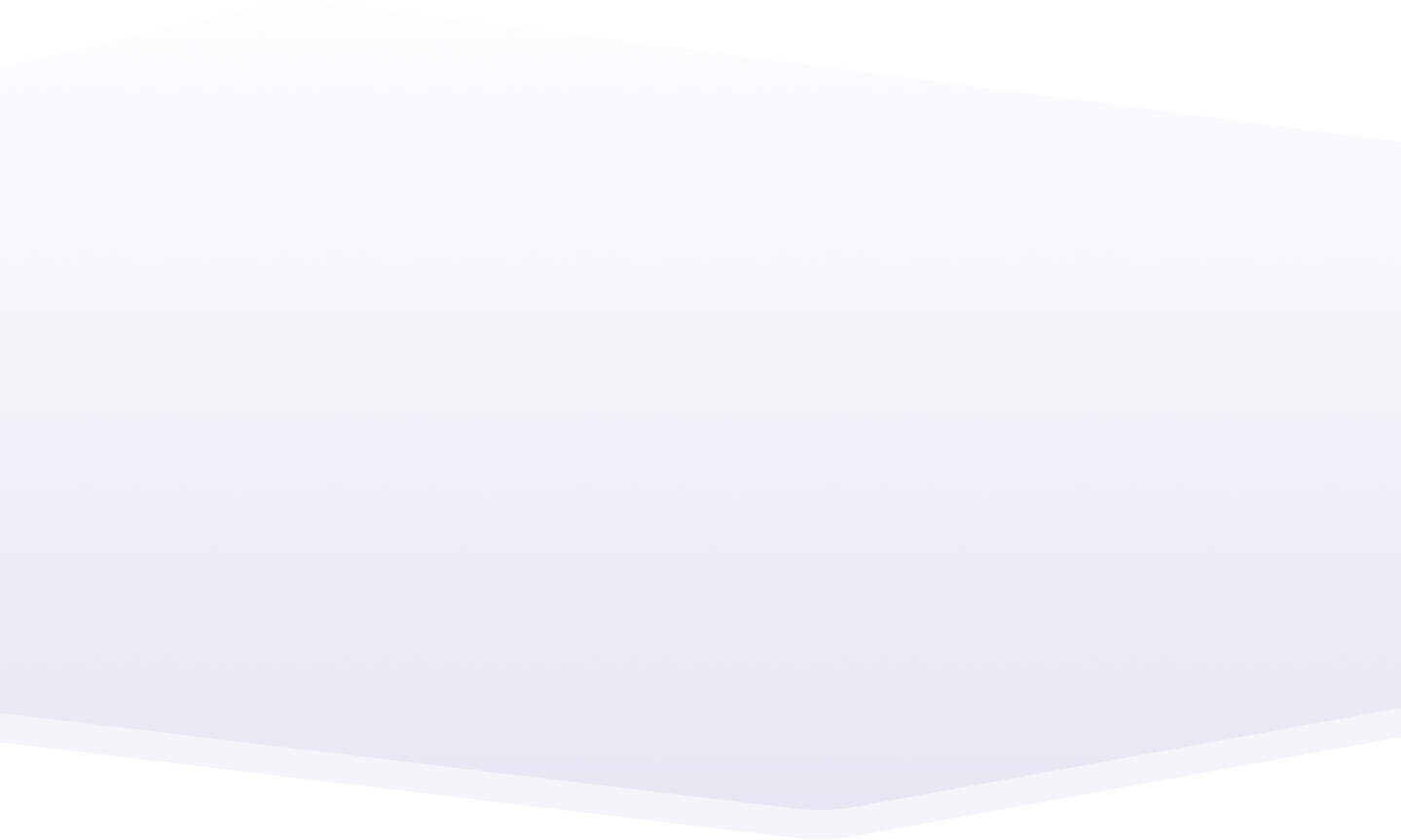

How do I calculate my total limit?

Tap ‘Calculate limit’ in the ‘Loans’ section. We will request your credit history, and in a few seconds, you will receive your limit. If we need more time, you will receive the result in a push notification.

Can I use up my entire limit on a single loan?

Yes, if your total limit is up to UAH 200,000. If it is higher, you will not be able to spend the entire amount on a single loan, because each credit service has its own maximum loan amount. For example, if your limit is UAH 500,000 and the maximum for a single contract for a parcel on credit is UAH 200,000, you will not be able to take more. Within the total limit, you can apply for two parcels on credit, up to UAH 200,000.

What is the maximum limit?

UAH 500,000

Can I repay the loan early?

Yes, of course. You can repay the loan in full early without additional fees and interest by paying only the loan fee for the current month. To pay UAH 5,000 or more, you must provide your passport.

What happens if I pay more than the amount indicated in the schedule?

If you pay an amount that exceeds the scheduled payment, the excess will be used to repay the principal (body) of the loan. As the total debt is reduced, we will adjust the payment schedule - all subsequent payments will be evenly reduced. The loan term will remain the same.

How can I repay the loan early, and how much does it cost?

Find out the amount you need to pay for full repayment. You can do this in the NovaPay mobile application, in the Nova poshta mobile application, or at any Nova poshta branch

What if the borrower is called up for military service?

We are grateful to everyone who has stood up to defend Ukraine. Borrowers in the military are exempt from paying interest on the loan. They are also not subject to fines and penalties for late loan repayment. These privileges are provided for by the Law «On Social and Legal Protection of Servicemen and Members of Their Families». To receive the privilege, the borrower or their close relatives must notify the bank of their military service and provide supporting documents::

- a military ID card with service marks in the relevant sections;

- or a certificate of call-up for military service issued by a military commissariat or military unit;

- for reservists - an extract from the order or a certificate of enrollment in the military unit;

- other documents confirming military service.

You can report in a way that is convenient for you:

- by e-mail to [email protected];

- by letter to the address 03026, Kyiv, Stolychne Shosse, 103, building 1, 13th floor, office 1307;

- by phone at 0 800 30 79 30

How can I find out my current debt status and how much I have to pay for the loan?

You can check your debt, the amount and date of the following payment, and other loan information in the NovaPay mobile app, in the Nova poshta mobile app or the NovaPay contact center.

- In the NovaPay mobile application, go to the «Loans» menu at the bottom of the screen. Select the desired loan from the list and go to the loan details, where you can see the amount of the loan debt, the amount, and status of the current payment and the date by which it must be paid.

- In the Nova poshta mobile app, go to the «Personal Account». To do this, click on the person icon at the top of the screen. Then select «Parcel on credit» and go to the «Open loans» section.

- Call the contact center at 0 800 30 79 30 to find out the amount to be paid in full, the amount of the current payment, and the existing debt. To call the contact center, use the phone number on which the loan was issued.

Can I find out another person's current debt status?

For security reasons, we provide information on loans only to the person who has arranged them.

Can I get a certificate of full repayment of the loan?

Yes, to do this, you need to contact the contact center at 0 800 30 79 30 and fill out an application. To call the contact center, use the phone number on which the loan was issued.

Can I receive a parcel on credit by power of attorney?

Only the person indicated as the recipient of the parcel can receive the parcel on credit. Issuing a loan by power of attorney is not provided by the terms of the service.

Place for

Place for